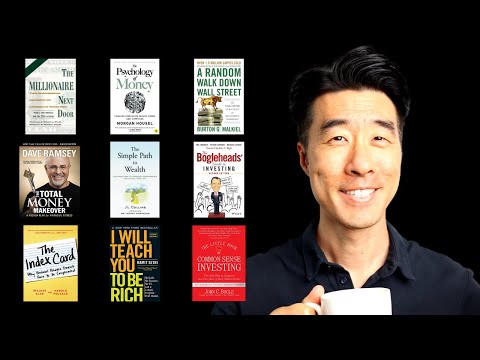

Best Investment Books Things To Know Before You Buy

Wiki Article

The most beneficial Expense Guides

Interested in getting to be a far better investor? There are several textbooks that can help. Productive buyers browse extensively to produce their techniques and continue to be abreast of rising tactics for financial investment.

The Basic Principles Of Best Investment Books

Benjamin Graham's The Clever Investor is surely an indispensable tutorial for just about any investor. It covers anything from elementary investing procedures and possibility mitigation procedures, to price investing techniques and procedures.

Benjamin Graham's The Clever Investor is surely an indispensable tutorial for just about any investor. It covers anything from elementary investing procedures and possibility mitigation procedures, to price investing techniques and procedures.one. The Very little Ebook of Prevalent Perception Investing by Peter Lynch

Prepared in 1949, this vintage function advocates the worth of investing that has a margin of security and preferring undervalued stocks. A necessity-read through for anyone thinking about investing, specifically those on the lookout past index cash to discover certain substantial-price prolonged-expression investments. Additionally, it covers diversification concepts and also how to avoid staying mislead by marketplace fluctuations or other Trader traps.

This ebook supplies an in-depth tutorial regarding how to become a successful trader, outlining every one of the ideas just about every trader should know. Subjects talked over during the e-book vary from marketplace psychology and paper investing practices, keeping away from frequent pitfalls for example overtrading or speculation and even more - making this reserve crucial studying for critical buyers who would like to make certain they have an in-depth understanding of elementary buying and selling concepts.

Bogle wrote this complete reserve in 1999 to get rid of light-weight about the hidden expenses that exist inside of mutual funds and why most investors would profit more from purchasing reduced-price index resources. His tips of preserving for rainy day funds even though not positioning your eggs into a single basket together with purchasing low-cost index resources continues to be legitimate nowadays as it was again then.

Robert Kiyosaki has extended championed the necessity of diversifying profits streams by means of real-estate and dividend investments, significantly housing and dividends. When Wealthy Dad Bad Dad may tumble additional into private finance than private development, Wealthy Father Poor Dad continues to be an informative study for any person wishing to raised comprehend compound desire and the way to make their dollars operate for them in lieu of against them.

For a little something much more contemporary, JL Collins' 2019 reserve can provide some much-wanted standpoint. Meant to address the needs of monetary independence/retire early communities (Fireplace), it concentrates on reaching fiscal independence by frugal dwelling, low price index investing plus the 4% rule - and also techniques to reduce student financial loans, invest in ESG belongings and take advantage of on-line investment decision methods.

2. The Little Ebook of Stock Market Investing by Benjamin Graham

Enthusiastic about investing but unsure the best way to move forward? This reserve offers functional direction composed especially with young investors in your mind, from important pupil mortgage credit card debt and aligning investments with private values, to ESG investing and on the web money assets.

This finest financial commitment e-book shows you how to determine undervalued stocks and develop a portfolio that will provide a continual source of money. Applying an analogy from grocery buying, this greatest reserve discusses why it is more prudent to not focus on expensive, well-promoted items but as an alternative focus on low-priced, neglected kinds at profits costs. Also, diversification, margin of security, and prioritizing price more than advancement are all discussed extensively in the course of.

A typical in its area, this ebook explores the fundamentals of benefit investing and how to determine prospects. Drawing on his financial commitment enterprise Gotham Funds which averaged an annual return of 40 % throughout 20 years. He emphasizes averting fads while acquiring undervalued corporations with sturdy earnings prospective buyers and disregarding short-expression current market fluctuations as crucial rules of prosperous investing.

This best investment decision ebook's writer gives information for new traders to stay away from the mistakes most novices make and increase the return on their funds. With stage-by-stage Guidelines on making a portfolio designed to steadily grow after some time plus the writer highlighting why index resources deliver the most efficient suggests of investment, it teaches readers how to maintain their strategy no matter market place fluctuations.

Best Investment Books Fundamentals Explained

While 1st revealed in 1923, this book stays an priceless guideline for anyone serious about handling their funds and investing wisely. It chronicles Jesse Livermore's experiences - who gained and check here lost thousands and thousands about his life span - although highlighting the importance of likelihood concept as A part of selection-creating processes.

While 1st revealed in 1923, this book stays an priceless guideline for anyone serious about handling their funds and investing wisely. It chronicles Jesse Livermore's experiences - who gained and check here lost thousands and thousands about his life span - although highlighting the importance of likelihood concept as A part of selection-creating processes.In case you are looking for to improve your investing competencies, you will discover quite a few great books on the market so that you can pick. But with restricted hrs in each day and limited readily available looking through content, prioritizing only People insights which supply quite possibly the most value is often difficult - And that's why the Blinkist application presents this sort of easy access. By accumulating vital insights from nonfiction textbooks into Chunk-sized explainers.

three. The Minimal Guide of Benefit Investing by Robert Kiyosaki

Best Investment Books for Dummies

This ebook handles investing in businesses with the economic moat - or aggressive edge - which include an financial moat. The creator describes what an financial moat is and provides samples of a few of the most renowned here corporations with 1. Additionally, this reserve particulars how to ascertain a corporation's benefit and purchase shares according to price tag-earnings ratio - ideal for newbie buyers or anybody wanting to discover the basics of investing.

This ebook handles investing in businesses with the economic moat - or aggressive edge - which include an financial moat. The creator describes what an financial moat is and provides samples of a few of the most renowned here corporations with 1. Additionally, this reserve particulars how to ascertain a corporation's benefit and purchase shares according to price tag-earnings ratio - ideal for newbie buyers or anybody wanting to discover the basics of investing.This doorstop investment guide is both of those well-liked and extensive. It addresses most of the finest tactics of investing, for instance beginning younger, diversifying extensively rather than paying out large broker service fees. Prepared in an attractive "kick up your butt" style which can either endear it to visitors or convert you off completely; although covering a lot of prevalent items of recommendation (devote early when Many others are greedy; be wary when Other folks develop into overexuberant), this click here text also suggests an indexing approach which seriously emphasizes bonds when compared with many comparable tactics.

This e-book offers an insightful strategy for inventory selecting. The writer describes how to pick out profitable stocks by classifying them into 6 distinctive groups - sluggish growers, stalwarts, speedy growers, cyclical shares, turnarounds and asset performs. By subsequent this straightforward system you improve your odds of beating the marketplace.

Peter Lynch is one of the entire world's Leading fund administrators, obtaining operate Fidelity's Magellan Fund for thirteen years with an average return that defeat the S&P Index each year. Published in 2000, his e book highlights Lynch's philosophy for choosing shares for individual buyers within an accessible manner that stands in stark contrast to Wall Street's arrogant and overly specialized tactic.